Design for FinTech

Bridge the gap between local businesses and consumers with card-linked offers. (Working in progress)

The MHCI numo team has conducted qualitative and quantitative research to understand how we can create value for merchants and consumers via Card-Linked Offers.

Problem

PNC introduced Card-linked offers (CLO) on debit cards. However, these offers did not gain traction amongst bank customers. Our team is exploring the CLO space to discover unmet customer needs and come up with better metrics to measure the value of a CLO for banks, merchants, and customers.

Solution (Working in progress)

We triangulated results from multiple research methods to develop a comprehensive understanding of the Card-Linked Offers space and validate findings across different sources. We are diverging in the “define phase”, where we are iterating and testing ideas through speed-dating storyboards and prototype testing.

My role

Conduct user research

Develop prototypes

Create and iterate on wireframes

Team

Kyle Barron

Niharika Jayanthi

Mia Manavalan

Lauren Whittingham

Duration

Jan, 2020 - Aug, 2020

The Process

1.

Discover

- secondary research

- Learn from merchants

- Learn from consumers

2.

Define

- Create personas

- Validate assumptions

- Create prototypes

- Iterate on prototypes

3.

Design (WIP)

- Create workflows

- Create and iterate on wireframes

- Usability test

- Hi-fi wireframes

4.

Deliver (WIP)

- Create design spec

- Create working prototype

test

1. Discover

What is Card-linked offer?

CLOs (Card-linked offers) are a form of deal that is attached to one’e card. The consumer links the card to a store they are planning to purchase in on an app. After they go into the store and use the card for a purchase, they receive the cash-back.

How CLO works?

Activate offers on the bank App

Purchase with the card

Get cash back

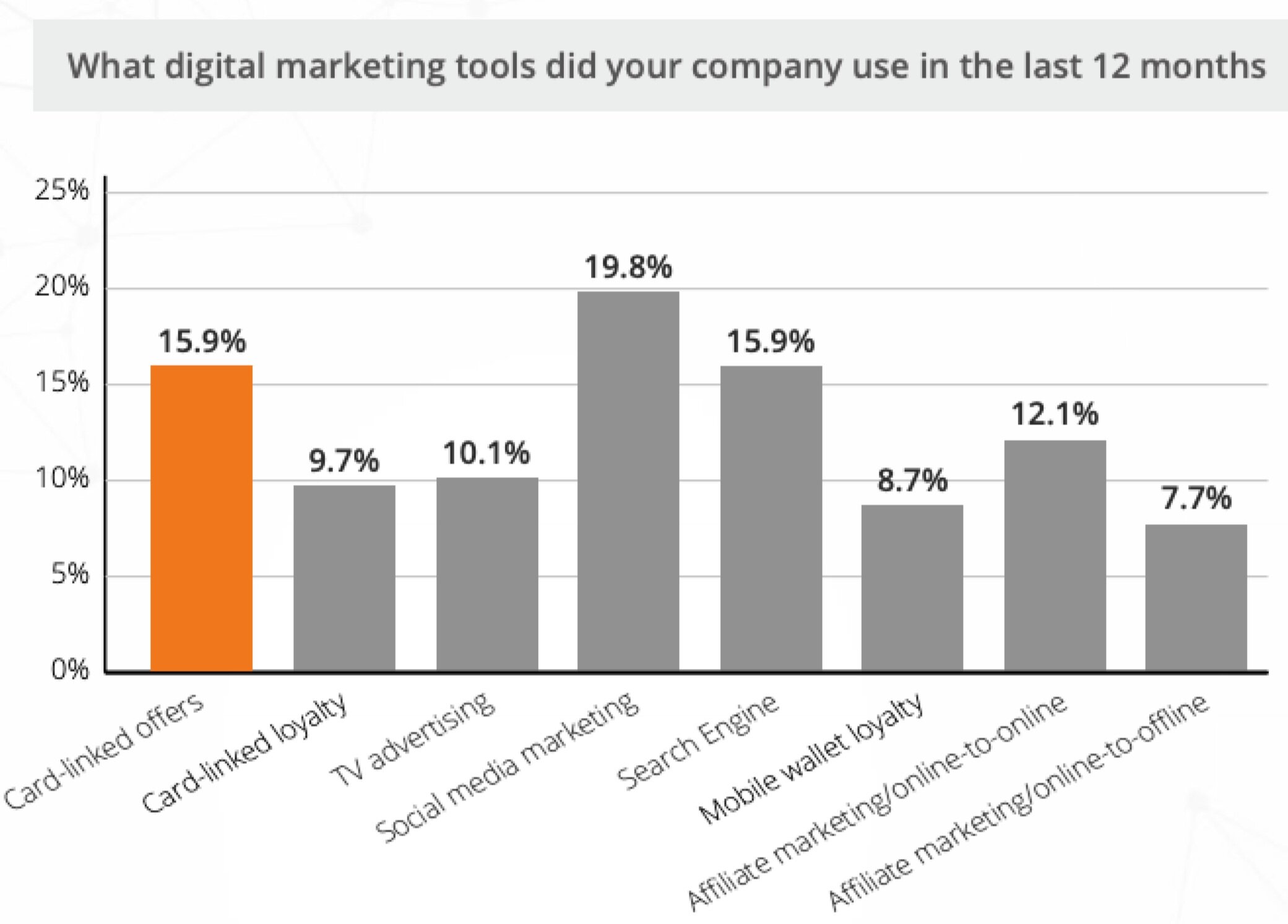

2nd Most Popular Digital Advertising Channel

According to eMarketer, the digital ad spent estimates in 2019 was $129 billion. Card-linked Marketing moved up to the second most preferred channel among all digital marketing tools, emerging as a mainstream advertising channel along with social media marketing and search engine optimization.

Source: Card-Linking and O2O Industry Survey 2019, The CardLinx Association

Organize value flows with a stakeholder map

There are multiple players in the CLO space, including publisher apps, banks, merchants, consumers, and service providers, represented by Cardlytics. Here is the stakeholder map we created. Our team iterated on the stakeholders a few times and finally settled on this diagram.

Key takeaways

This secondary research allowed us to gain a comprehensive understanding of the types of companies and technologies that exist related to Card-Linked Offers. It also helped us figure out the right questions to answer in the following primary research.

1.

Tension exists between consumers and merchants because consumers do not receive offers automatically.

2.

Users are inundated with offers that aren’t relevant to them.

3.

Small merchants are not well represented in CLOs.

Learn from merchants

After establishing knowledge of the world of card-linked offers, our next step was to go out and talk to our stakeholders about these card-linked offers to understand better the public awareness and feelings surrounding them.

Semi-structured interviews

The primary research method we used for merchant research was semi-structured interviews. We conducted a total of 10 merchant interviews and made sure to focus on different types of merchants, including restaurants, retailers, service merchants, etc.

Merchants we have talked to

Generate insights through affinity diagramming

To transform our findings into insights, we created an affinity diagram. This type of insight generation allowed us to organize our massive number of findings into digestible groups and develop relationships. We also made sure these insights were clear so that we could make informed design decisions based on them.

Insights from merchants

1.

Merchants are struggling to compete with online retail giants like Amazon.

“Online retailers and Amazon are slowing down my business. Traffic has been down over the last couple years since online options.”

2.

Merchants turn to POS systems to help run daily businesses.

“I use my PoS system to track inventory, and get ratios of new vs. returning customers.”

3.

Merchants need a way to calculate the value of marketing.

4.

Merchants face a myriad of paint points with POS systems.

Learn from consumers

As our second main stakeholder, we needed to understand both sides of card-linked offers. It can feel like there is a conflict of interest between merchants who want to increase their profits and consumers who want to spend less, so both points of view are essential to create a solution that benefits both parties.

Guerrilla research

Goal:

To understand how different demographics of people are saving.

To learn their awareness of Card-Linked Offers and problems faced when using cashback offers

To learn the types of retailers they want offers from.

We conducted over 25 interviews in a variety of locations (included universities, Target, Giant Eagle, and Home Depot. ) so we could target different potential user groups.

TAP (Think Aloud Protocols)

From our guerrilla research, we learned that many consumers were unfamiliar with any CLO. We determined our next step was to conduct TAP on both PNC's card-linked offers as well as publisher apps, like Dosh, and continue to ask the same semi-structured interview questions. We chose TAP, less for usability feedback, and more to gauge their response as they experienced and interacted with the apps.

Interpretation with affinity diagram

Using the same affinity diagram method from the merchant research, we extrapolated the following insights.

Insights from consumers

1.

Saving money means different things to people, including limiting spending, making money through stocks, investments, etc.

“I consider myself proactive about saving money. I invest 10% of my savings from income in stocks”

2.

Deals can be viewed as a way to manipulate consumer spending rather than saving money.

“I worry deals might lead to me making unnecessary purchases and waste my money.”

3.

Offers need to be personalized so people can take advantage of them, and people want cashback offers that fit their lifestyle more.

“If deals were personalized to me, then I would care about them more. It will make the experience more meaningful.”

4.

Security and privacy are important concerns for users when adopting new tech.

“I’m worried about security for apps where I have to link my card and bank information.”

5.

If the value created exceeds the effort spent, then people will use CLOs more.

“I feel the time spent using the app has to be proportional to money saved to make it worthwhile.”

6.

Banks can offer more value to their target audience by associating debit cards with rewards.

7.

The immediate and significant value must be shown to users to utilize CLO apps.

8.

Education about CLO processes is crucial to get people to adopt it.

2. Define

Create personas

Since we had a ton of primary research conducted with consumers and merchants, we had lots of data to examine that we could create personas from. Personas allowed our team to understand our users' behaviors, experiences, pain points, and feelings. Personas were an excellent strategy to take so that we could ground our designs in them.

Merchant personas

Consumer personas

Key takeaways

These personas allowed us to iterate on our ideas based on how these personas would utilize the solutions. Moving forward, we constantly referred back to the personas to make sure they were being created with these target users in mind.

Validate assumptions with storyboards

Based on these insights we generated, our next step was to create storyboards for both stakeholders: merchants and consumers.

We created “How might we” statements for both stakeholders. For example, “How might we save consumers more money by understanding their spending habits,” and “How might we promote local business through a customizable POS system?” Then we created storyboards to answer these statements and conducted rounds of speed dating sessions with both stakeholders to get their feedback.

Results from consumers

1.

Consumers want to get the deal with the least effort.

2.

Consumers need more incentive to explore local businesses, for example, restaurants.

3.

If the price of local stores is the same as the online retailers, if not cheaper, consumers are willing to shop locally to show their support.

4.

It is a great way for consumers to show support and to learn investment by reinvesting the money received from cashback to local businesses.

Results from merchants

1.

Merchants wish PoS can help them with customer relationship management.

2.

Merchants hope to provide customers with more attractive incentives through the establishment of local business networks.

Create and test concept prototypes

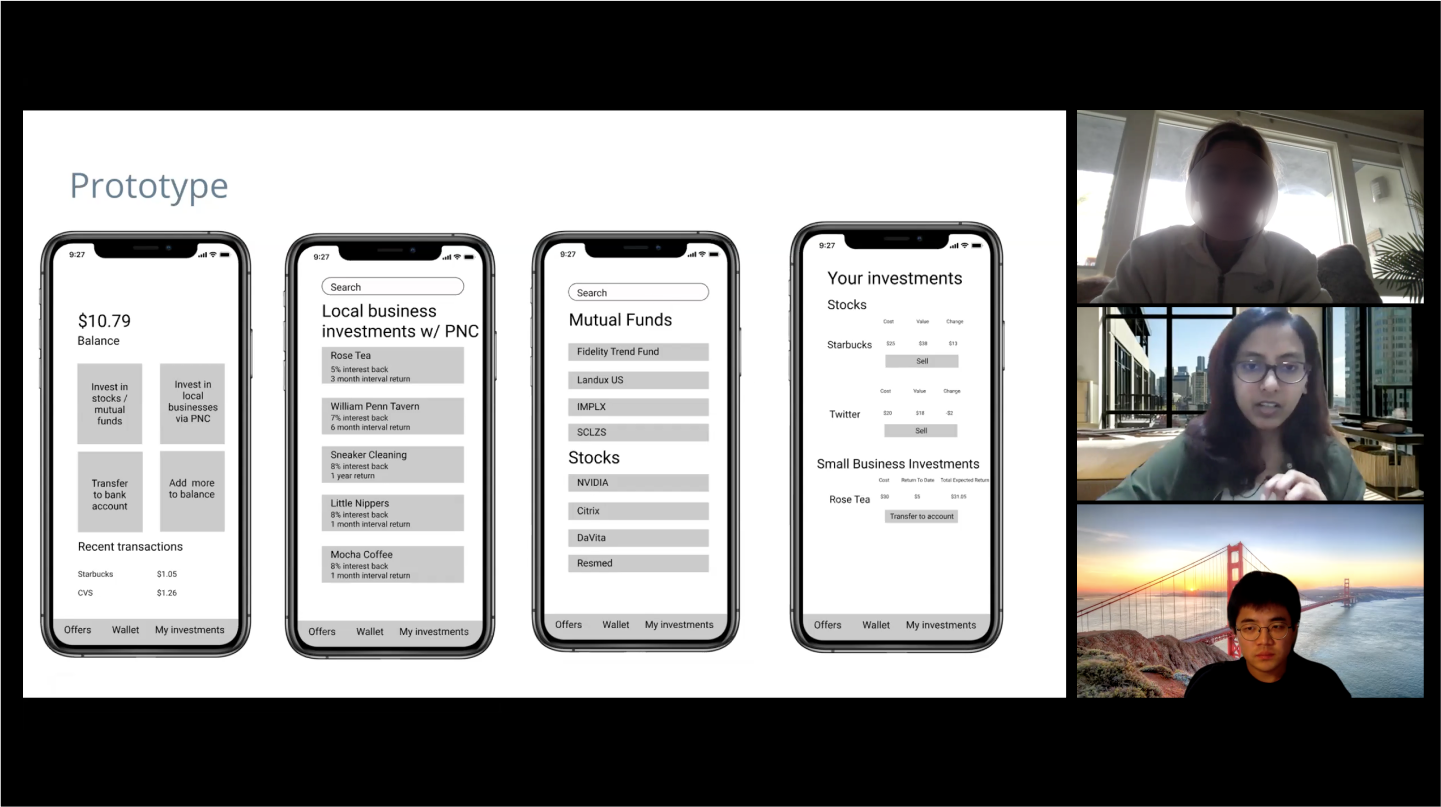

Even though users said they were interested in those ideas presented in storyboards, it was hard to realize if they would use it. We developed low-fidelity prototypes and asked users to test them to gain more insights into the practicality and usability of these ideas.

Narrow down concepts

Based on the feedback from our interviews, we decided to move forward with two ideas from which we received positive feedback. Meanwhile, we will create merchant views of these two directions by incorporating some of the feedback we got from merchant storyboard speed-dating sessions.

1.

Investing in local businesses

An application enables users to invest their own money, and that received from cashback in local businesses.

2.

Restaurant tracker

An application rewards users for trying out restaurants they had not yet been to.

Iterate on prototypes

We started to iterate on both ideas: investing in local businesses and a restaurant tracker. We fleshed out more details on the consumer side and created merchant views of these two directions.

Investing in local businesses

Restaurant tracker

Investing in local businesses - Consumer

Consumers can invest in multiple local businesses with either their own money or that received from cashback. In return, they can get perks from the businesses they have invested in.

Investing in local businesses - Merchant

On the merchants' side, they can check how much they get from investors and can also customize perks for these investors to attract them to the stores.

Restaurant tracker - Consumer

With the restaurant tracker, consumers can explore new restaurants around them together with deals. They can also create "food friends" groups to feed or receive a suggestion from friends.

Restaurant tracker - Merchants

Merchants can use the tracker to view the preference of individual groups and send customized deals to them. The system can also provide them with performance data and industry average to help them extract insights from comparisons and grow their businesses.

Summer planning with clients

After the spring presentation, we had a summer planning session with our two clients. This meeting was extremely effective in understanding what aspects of these ideas they liked.

Key Takeaways

1.

We need to focus on the value of specific features when including them in the prototype. Too many features may seem like we’re trying to test out many different ideas at once.

2.

Continue to take this idea of Card-Linked Offers a step further and come up with innovative ideas that haven’t been thought of before.

3.

We may benefit from honing in on one or two specific types of users. We don’t need to create solutions that could benefit a variety of different user groups.

Next step

As our team moves into the summer semester, we’ll be taking a step back and figuring out our target users to focus on and what problems we want to solve. This might include conducting more research on those types of users. After, we will choose a design direction, and then move fully into our second diamond in the double diamond model. We will create prototypes and iterate on them. Our summer plans also include extensive usability testing, and careful feature selection. In addition, we’ll be creating a 5 year roadmap that includes future milestones to convey our strategic thinking. We are thrilled with the progress we have already made, and are excited to keep moving forward!