Design for FinTech

Bridge the gap between local businesses and consumers with card-linked offers. (Work in Progress)

The MHCI numo team has conducted qualitative and quantitative research to understand how we can create value for merchants and consumers via Card-Linked Offers.

Problem

PNC’s Card-Linked Offers (CLO) on debit cards has not gained traction amongst bank customers as expected. Our team have been exploring the CLO space to identify unmet customer needs and come up with better metrics to measure the value of CLO for banks, merchants and consumers.

Solution (Work in Progress)

We triangulated research results to develop a comprehensive understanding of the CLO space as well as cross validate findings from different sources. We also diverged into two “design” directions after the “define” phase: iterating and testing ideas through speed-dating storyboards vs. prototype testing.

My role

As the design lead of the team, my responsibilities are:

Conduct primary and secondary user research

Create storyboards to learn user needs

Design and iterate prototypes

Conduct user testings

Create and maintain a design system

Lead the design of high-fidelity prototypes

Team

Kyle Barron

Niharika Jayanthi

Mia Manavalan

Lauren Whittingham

Duration

Jan, 2020 - Aug, 2020

The Process

1.

Discover

- secondary research

- Gather information from merchants

- Gather information from consumers

2.

Define

- Create personas

- Validate assumptions

- Create prototypes

- Iterate on prototypes

3.

Design (WIP)

- Create workflows

- Create and iterate wireframes

- Conduct usability test

- Create high-fidelity wireframes

4.

Deliver (WIP)

- Create design specs

- Create working prototype

1. Discover

What is Card-linked offer?

CLO is a digital marketing tool designed to link a special offer or a sales deal to a consumer’s debit or credit card. Consumers will earn discounts or cash back rewards by using their debit card to purchase from certain stores.

How CLO works?

Activate offers on the bank App

Purchase with the card

Get cash back

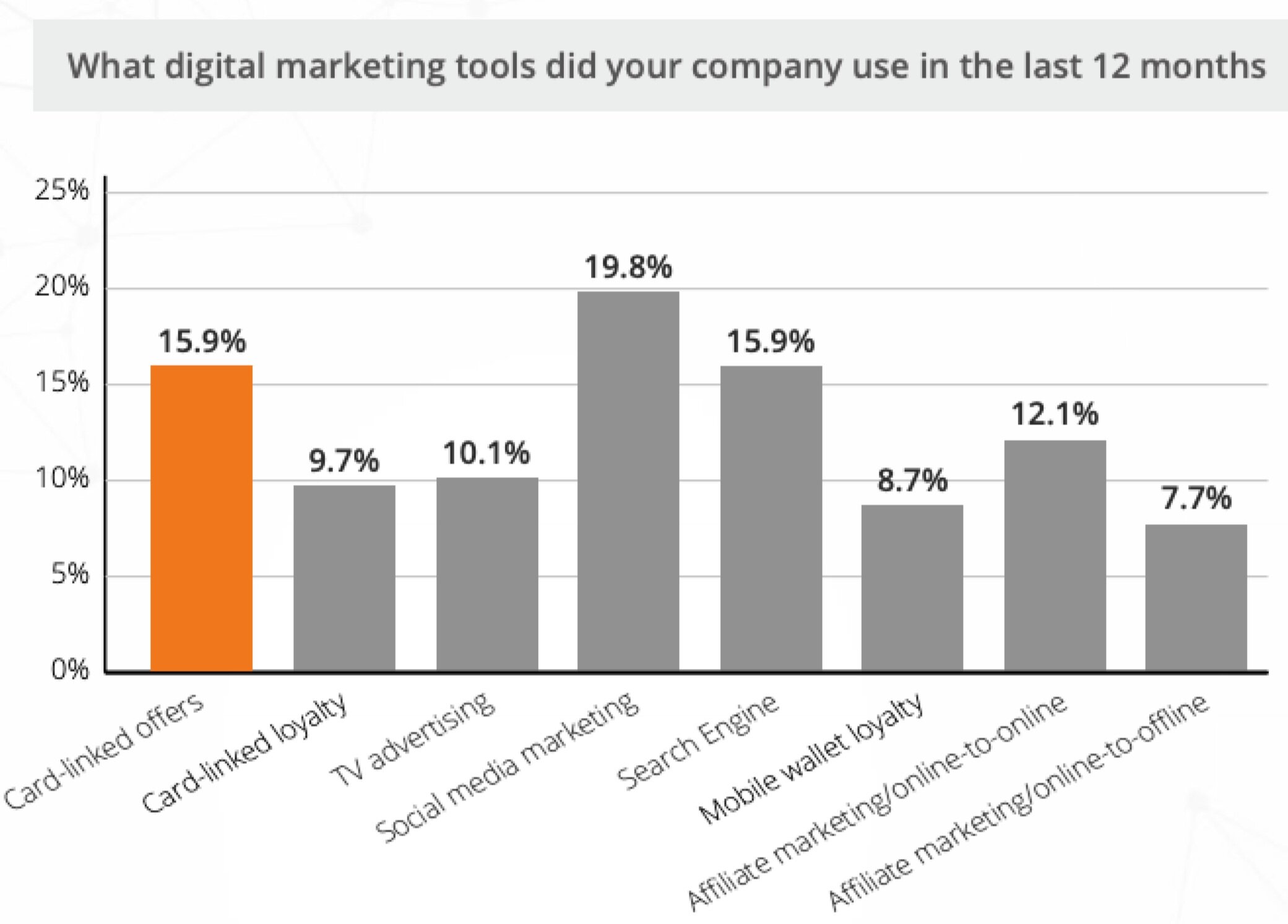

2nd Most Popular Digital Advertising Channel

According to eMarketer, the digital ad spent was estimated at $129 million in 2019. Card-linked Marketing moved up to the second most preferred channel among all digital marketing tools, emerging as a mainstream advertising channel along with social media marketing and search engine optimization.

Source: Card-Linking and O2O Industry Survey 2019, The CardLinx Association

Organize value flows with a stakeholder map

Here is a stakeholder map our team created after rounds of iteration.

Key takeaways

This secondary research allowed us to gain a comprehensive understanding of the existing companies and technologies related to Card-Linked Offers.

1.

Consumers have to manually activate CLOs in their banking apps instead of receiving offers automatically

2.

Users are inundated with offers that are of little interest to them.

3.

Small merchants are not well represented in CLOs.

Gather information from merchants

After researching on CLO, we had discussions with our stakeholders to get more insight into the public awareness and feelings around them.

Semi-structured interviews

For learning more about CLO from merchants, we conducted semi-structured interviews as the primary research method. We made sure to include different types of merchants - restaurants, retailers, services and more - and did 10 interviews in total.

Merchants we have talked to

Generate insights through affinity diagramming

To transform our findings into insights, we created an affinity diagram. This type of insight generation allowed us to organize our massive number of findings into digestible groups and develop relationships. We also made sure these insights were clear so that we could make informed design decisions based on them.

Insights from merchants

1.

Merchants are struggling to compete with online retail giants like Amazon.

“Online retailers and Amazon are slowing down my business. Traffic has been down over the last couple years since online options.”

2.

Merchants are used to relying on POS system for daily businesses.

“I use my PoS system to track inventory, and get ratios of new vs. returning customers.”

3.

Merchants need a way to calculate the value of marketing.

4.

Merchants face a myriad of paint points with POS systems.

Gather information from consumers

As consumers are our second main stakeholder, we need to learn more about what they think to get a whole picture of CLO. Since there is a potential conflict of interest between merchants who want to increate their revenues and consumers who want to spend less money, both perspectives become essential for us to find a solution that can benefit both parties.

Guerrilla research

Goal:

To understand how different demographics save money.

To learn about their awareness of CLO and the problems they face when activating cash back offers.

To learn the types of retailers they want offers from.

We conducted over 25 interviews in a variety of locations (included universities, Target, Giant Eagle, and Home Depot. ) so we could target different potential user groups.

TAP (Think Aloud Protocols)

We determined that our next step would be conducting TAP on both PNC’s CLO as well as publisher apps (i.e. Dosh) and continuing asking the same questions for semi-structured interviews. We would utilize TAP less for usability feedback, rather, more for gauging consumers’ response as they interacted with the apps.

Interpretation with affinity diagram

Using the same affinity diagram method from the merchant research, we extrapolated the following insights.

Insights from consumers

1.

Saving money means different things to different people: reducing expenses, making money in stocks, investments, etc.

“I consider myself proactive about saving money. I invest 10% of my savings from income in stocks”

2.

A sales deal can sometimes be regarded as a way to manipulate consumers to spend more money rather than save money.

“I worry deals might lead to me making unnecessary purchases and waste my money.”

3.

Offers need to be personalized so people can take advantage of them, and people want cashback offers that suit their lifestyle.

“If deals were personalized to me, then I would care about them more. It will make the experience more meaningful.”

4.

Security and privacy are important concerns for users when adopting new tech.

“I’m worried about security for apps where I have to link my card and bank information.”

5.

If the value created exceeds the effort spent, then people will use CLOs more.

“I feel the time spent using the app has to be proportional to money saved to make it worthwhile.”

6.

Banks can offer more value to their target audience by associating debit cards with rewards.

7.

Immediate and significant values must be obvious to users in order for them to use CLO apps.

8.

Education about CLO processes is crucial to get people to adopt it.

2. Define

Create personas

Since we conducted a substantial amount of primary research with consumers and merchants, we accumulated lots of data that we could use to create personas in which we would ground our designs. Creating personas was an excellent strategy that allowed our team to understand user behaviors, experiences, paint points and feelings.

Merchant personas

Consumer personas

Key takeaways

The personas helped us iterate our ideas through coming up with different scenarios of how they would utilize the solutions.

Validate assumptions with storyboards

Based on these insights we generated, our next step was to create storyboards for both stakeholders: merchants and consumers.

We created “How might we” statements for both stakeholders. For example, “How might we save consumers more money by understanding their spending habits,” and “How might we promote local business through a customizable POS system?” Then we created storyboards to answer these questions and conducted rounds of speed dating sessions with both stakeholders to get their feedback.

Results from consumers

1.

Consumers want to get the deal with the least effort.

2.

Consumers need more incentive to explore local businesses, for example, restaurants.

3.

If a product is being sold at the same price in local stores and online, consumers are willing to shop locally to show their support.

4.

It is a great way for consumers to show support and to learn investment by reinvesting the money received from cashback to local businesses.

Results from merchants

1.

Merchants wish PoS can help them with customer relationship management.

2.

Merchants hope to provide customers with more attractive incentives through the establishment of local business networks.

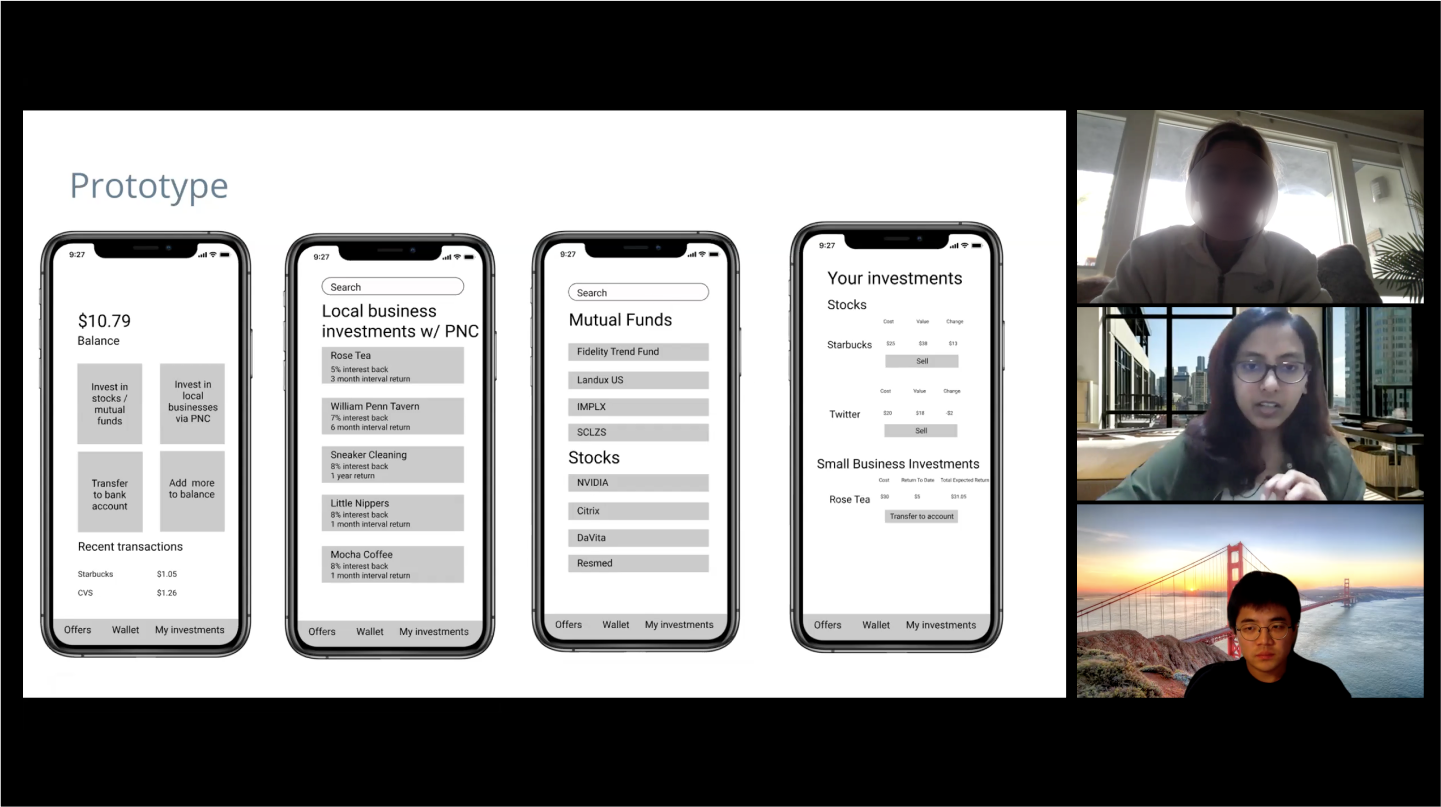

Create and test concept prototypes

Even though users expressed their interest in our storyboards, it was hard to measure the possibility of them actually using CLOs. We developed low-fidelity prototypes to test with users so that we could gain more insight into the practicality and usability of these ideas.

Next step

As the Summer semester approaches, our team will continue creating and iterating prototypes. Our Summer plans also include extensive usability testing and careful feature selection. In addition, we will make a 5-year roadmap with future milestones to convey our strategic thinking. We are thrilled about the progress we’ve made so far and cannot wait to move forward!

Other work